PENN PENN Entertainment Inc Analyst Estimates & Rating

The company is scheduled to release its next quarterly earnings announcement on Thursday, November 2nd 2023. Sign-up to receive the latest news and ratings for PENN Entertainment and its competitors with MarketBeat’s FREE daily newsletter. When you see PENN stock appear in the results, tap it to open up the purchase screen. Provides a general description of the business conducted by this company. Disney isn’t getting out of the sports business, it’s trying to play a central role in the future of sports. While it looks as though the major indexes will end up down on the week, their first in the last three, there remain some unusually active options that allow you to buy these stocks for only $150 down….

Alternative Assets.Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of 1933 (as amended) (“Regulation A”). These investments are speculative, involve substantial risks (including illiquidity and loss of principal), and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser. The issuers of these securities may be an affiliate of Public, and Public (or an affiliate) may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures.

Per-Share Earnings, Actuals & Estimates PENN Entertainment Inc.

30 employees have rated PENN Entertainment Chief Executive Officer Jay Snowden on Glassdoor.com. Jay Snowden has an approval rating of 87% among the company’s employees. Get this delivered to your inbox, and more info about our products and services.

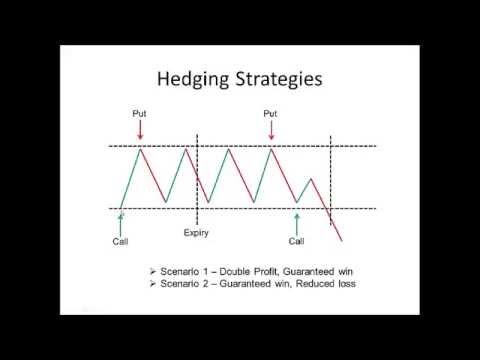

The Barchart Technical Opinion rating is a 100% Sell with a Strongest short term outlook on maintaining the current direction. Gaming, specifically gambling, is growing in all segments and these companies are working hard to cement their positions and drive results for shareholders. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Related Articles PENN

Shares in sports gambling names have fallen in the wake of Penn’s $2 billion deal for ESPN rights. Belpointe Chief Strategist David Nelson joins Yahoo Finance Live anchors Seana Smith and Akiko Fujita to discuss the stock market, interest rates, and why his buys are Disney (DIS) and energy sector s… Truist Securities analyst Barry Jonas downgraded his rating of Penn to Hold from Buy. Joe Pompliano, Sport Business Analyst, joins ‘Last Call’ to talk the PENN-ESPN deal, why Penn’s stock is lower and what the future of the partnership could look like.

Compare

PENN’s historical performance

against its industry peers and the overall market. Morningstar analysts hand-select direct competitors or comparable companies to

provide context on the strength and durability of PENN’s

competitive advantage. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

Financials

In February 2020, casino operator and online betting company Penn Entertainment Inc. took a 36% stake in Barstool Sports for $161 million. With the ESPN and Penn Entertainment deal, Disney is officially entering the world of sports betting. PENN’s beta can be found in Trading Information at the top of this page.

ESPN Bet Sports Gambling Platform Will Be Massive: 5 Top ‘Strong Buy’ Stocks May Be Huge Winners – 24/7 Wall St.

ESPN Bet Sports Gambling Platform Will Be Massive: 5 Top ‘Strong Buy’ Stocks May Be Huge Winners.

Posted: Tue, 12 Sep 2023 11:10:07 GMT [source]

The retail portfolio generates high-30% EBITDAR margins and helps position the company to obtain licenses for the digital wagering markets. Additionally, Penn’s media assets, theScore and ESPN (starting with its partnership launch in Fall of 2023), provide access to sports betting/iGaming technology and clientele, helping it form a leading digital position. 17 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for PENN Entertainment in the last twelve months. The consensus among Wall Street analysts is that investors should “hold” PENN shares. A hold rating indicates that analysts believe investors should maintain any existing positions they have in PENN, but not buy additional shares or sell existing shares.

Is PENN Entertainment (PENN) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. 17 analysts have issued 12-month price objectives for PENN Entertainment’s stock.

Penn Entertainment (PENN) stock is up on the news of the company’s sports betting deal with ESPN (DIS). Yahoo Finance’s Josh Schafer joins the Live show to discuss the sports betting market, whether t… High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

PENN Entertainment Inc. stock falls Thursday, underperforms market

Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Open to the Public Investing’s Fee Schedule to learn more. JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. Additional information about your broker can be found by clicking here.

- The analysts see these stocks trading at extreme lows with nowhere to go but up, and there are catalysts to drive their markets higher.

- Shares in sports gambling names have fallen in the wake of Penn’s $2 billion deal for ESPN rights.

- PENN Entertainment’s stock is owned by a number of institutional and retail investors.

When Penn Entertainment Inc. announced plans on Tuesday to launch an ESPN-branded online sports-betting service, shares of the casino operator initially rallied. PENN Entertainment declared that its board has initiated a stock repurchase program on Thursday, February 3rd 2022, which permits the company to repurchase $750,000,000.00 in outstanding shares, according to EventVestor. This https://1investing.in/ repurchase authorization permits the company to buy up to 9.8% of its shares through open market purchases. Shares repurchase programs are generally an indication that the company’s board of directors believes its stock is undervalued. You can find your newly purchased PENN stock in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets.

PENN Entertainment shares drop below pre-ESPN deal levels

CNBC’s Julia Boorstin joins ‘The Exchange’ to discuss Disney’s upcoming earnings report, a decline in Disney’s Florida theme park performance, and ESPN’s $2 billion investment into Penn entertainment … ESPN just struck a $1.5 billion deal with Penn Entertainment to rebrand Barstool Sportsbook as ESPN Bet. ESPN will buy $500 million in shares of Penn, and sell its stake in Sportsbook back to founder …

Tower Research Capital LLC TRC Buys 20787 Shares of PENN … – MarketBeat

Tower Research Capital LLC TRC Buys 20787 Shares of PENN ….

Posted: Fri, 18 Aug 2023 07:00:00 GMT [source]

No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.

Disney’s ESPN has signed a long-term exclusive agreement with casino operator Penn Entertainment, licensing its brand for sports betting and deepening the media giant’s ties to the growing online gamb… Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The bailor meaning in law formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

Sobre o autor