Definition of “Closed Position” in Forex Trading

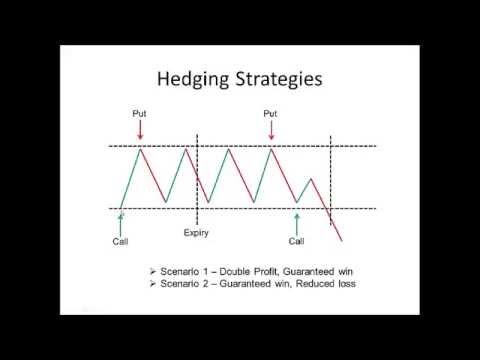

On the other hand, for value investors, the expected increase in share price is attributable to the inherently inefficient market realizing the asset’s current value. A Closed Position in a currency is one where any risk exposure in the foreign currency has been eliminated. The process to close a position is to sell or buy a specific amount of currency to offset an equal amount of currency in the respective open position. Closing a long position in a currency requires selling, and closing a short position in a currency requires buying. The difference between a close position and a sell order is that a close position will always execute at the current market price, while a sell order may not. A closed position is when your order is matched with another order and the trade is complete.

The follower’s left hand is on the leader’s right shoulder, or the upper arm near the shoulder. The other two hands are clasped together at or near chest or shoulder height. If you’re unsure about whether or not to sell, you can always set a limit order. A limit order is an order to buy or sell a security at a specified price or better.

- If Congress fails to pass appropriations bills by Oct. 1, the federal government will shut down.

- This is because the trade is live and can still make profits or incur losses.

- A closed restroom at Zion National Park during the 2013 government shutdown.

- Investors usually take short positions due to their infinite risk because there is no upper limit to share prices.

- For hundreds of thousands of federal employees, that means either being furloughed while the government is closed, or continuing to work without pay.

Everything from family vacations to school field trips to weddings would be affected. As a general matter, doors will have to be locked and gates closed. If the trader closes the futures position for a loss the funds are withdrawn from the traders account and their account balance will go down. When traders close a futures position for a profit their account balance will increase.

What does an open or closed position mean?

Similarly, when a position is heavily up, it might also be difficult to close it out. The mindset alters, and there is an assumption that if it is now profitable, it will continue to increase. Again, this is not always the case, therefore closing out positions and securing profits is critical to success. Making a trading strategy is the greatest approach to close positions at the optimal level.

Closing a position is completing a securities transaction that is the inverse of an open position. This action nullifies the open position and removes the original exposure. Closing a long stock position entails selling an offsetting amount of shares. While closing a short position entails santa rally history purchasing an equal amount of offsetting shares. It is also a common practice to take offsetting positions in swaps to remove the risk before maturity. The benefit of investors placing an order in advance is that they do not have to wait over the computer for the order to fill.

What is a Swap in Forex and How to Calculate

You just need to make sure you are aware of any fees or taxes that may be due. This is important because it can help you factor in your profits or losses. Depending on your exit strategy and financial goals, there are various ways for you to close a position. You are nullifying, or eliminating, your initial exposure to an open position by closing it. As mentioned earlier, closing a position can mean different things depending on what you are doing in the markets.

The settlement process is finished, and the position is no longer active. When you close a long position, it means that you have sold the shares you bought. When an individual, such as a trader or investor, or an entity, such as a hedge fund or institution, purchases any amount of an asset in the stock market, they are opening a position. When the open position is closed by a stop loss, it means that the trade is exited automatically. A stop-loss works out if the price goes in the opposite trade direction to the forecast.

If you sell your position before the market closes, you can avoid this. For example, if you buy a stock and then immediately sell it, you have closed your position. But if you buy a stock and then hold onto it overnight, you have an open position.

Most of those employees will continue to work without pay until funding is restored. In rare cases, some may work in positions that are funded outside the annual appropriations process. For the public, that typically means dealing with interruptions to a variety of government services and facing a range of disruptions to daily life.

What a Federal Government Shutdown Means for National Parks

If the extent of the drop in the security price is large, the higher the profits investors will accrue. Investors usually take short positions due to their infinite risk because there is no upper limit to share prices. With long positions, losses are limited as share prices (see small-cap stocks) cannot drop lower than zero dollars. The time period between the opening and closing of a position in a security indicates the holding period for the security. This holding period may vary widely, depending on the investor’s preference and the type of security.

Government Shutdown Averted

For example, you may want to take profits on a trade or cut your losses if the stock price is going against you. Another reason to close a position is if the stock price reaches your target price. When you close a position, the transaction is processed and settled. For example, if you closed a long position by selling 100 shares of XYZ stock, you would receive the proceeds from that sale in your account. Occasionally, your positions may get involuntarily closed by your broker or clearing firm in a process called forced liquidation. For example, if you had a short position, but a short squeeze happens, and you end up getting margin called, your positions may get liquidated if you do not have enough funds to cover.

Hence, closing a position means completing a security transaction that is the exact opposite of an open position. Staff biologists, ecologists and other resource professionals work to rid our parks of invasive species and to protect the threatened and endangered species that call our national trade silver parks home. Other staff members monitor grounds to prevent vandalism, illegal dumping and other detrimental activities. This budget impasse is part of a broader funding crisis facing parks. Between 2012 and 2022, national parks staffing eroded by 13% while visitation grew by 10%.

And finally, if you are closing a short position, you may have to pay what’s called a short squeeze. This happens when the price of the stock goes up quickly and you have to buy the shares at a higher price than you sold them. On the other hand, if you sold those 100 shares of XYZ stock at $40 per share, you would have closed your position at a loss.

Definition of: Closed Positionin Forex Trading

When you close a position, you typically either lock in profits or take a loss. The difference between the opening and closing price of your position is the gross profit or loss (P&L). For example, you may want to reduce your exposure, need cash immediately, or want to cut your losses. It may not be necessary for the investor to initiate closing positions for securities that have finite maturity or expiry dates, such as bonds and options. In such cases, the closing position is automatically generated upon maturity of the bond or expiry of the option.

The Park Service found that the 16-day shutdown resulted in an estimated 8 million lost recreation visits and $414 million in lost visitor spending. Despite the chaos and damage that ensued, the Department of the Interior pressured superintendents to keep areas of parks open. After a months-long investigation, the Government Accountability Office determined that these actions were illegal based on the Antideficiency Act and Appropriations Law.

An open position in investing is any established or entered trade that has yet to close with an opposing trade. An open position can exist smart money concept following a buy, a long position, a sell, or a short position. In any case, the position remains open until an opposing trade takes place.

Exchange-Traded Fund ETF Explanation With Pros and Cons

Swing trading is used in order to take advantage of significant price swings in the price of a stock or other security. This could have a time interval of anywhere from a few days to a few months. ETFs are an ideal choice for swing trading because they have narrow bid/ ask spreads, as well as being easily diversified.

- These products use derivatives such as options or futures contracts to leverage their returns.

- An ETF provider creates an ETF based on a particular methodology and sells shares of that fund to investors.

- Mutual funds are priced once per day, and you typically invest a set dollar amount.

- The next step up from using a market order is that of the limit order.

On the other hand, ETFs trade just like stocks on major exchanges such as the NYSE and Nasdaq. For example, if you buy an S&P 500 ETF, your money will be invested in the 500 companies in that index. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. Asset allocation, which means allocating a portion of a portfolio to different asset categories—such as stocks, bonds, commodities and cash for the purposes of diversification—is a powerful investing tool. The low investment threshold for most ETFs makes it easy for a beginner to implement a basic asset allocation strategy, depending on their investment time horizon and risk tolerance. Real-time pricing of funds decays through contango, which reflects timing variations between a futures contract and spot prices.

You’re our first priority.Every time.

Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. For example, a corporate bond ETF will depend o fundamental research, such as a company’s credit rating, past and future earnings, as well as the economic outlook for their industry. With thinkorswim, you’ll have tools to help you build a strategy and more.

Trading options on ETFs is an edge so few traders use because they simply don’t know how to look at the sectors and use them when creating their watchlists and making their trades. The amount of redemption and creation activity is a function of demand in the market and whether the ETF is trading at a discount or famous investors premium to the value of the fund’s assets. The supply of ETF shares is regulated through a mechanism known as creation and redemption, which involves large specialized investors called authorized participants (APs). With a multiplicity of platforms available to traders, investing in ETFs has become fairly easy.

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. day trading tips Our partners cannot pay us to guarantee favorable reviews of their products or services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Understanding factor-based investing

The first commodity ETF for gold bullion was launched in 2003 on the Australian Securities Exchange. In 2004, State Street Corporation (STT) launched SPDR Gold Shares (GLD), the first US ETF backed entirely by physical gold – it surpassed $1bn in assets within its first three trading days. If you’re new to ETF investing, it’s important to understand the costs involved. Before investing your hard-earned dollars for real, you’d be wise to practice using a simulated trading application.

However, by trading ETFs rather than individual stocks, you can miss out if a particular stock price outperforms the market. Whether ETFs or stocks are a more appropriate investment for you would depend on your Buy google stock risk tolerance, investing or trading goals, timeframe and experience in the market. ETFs are an efficient way for new investors to start building a diversified portfolio, particularly with low-fee index funds.

There is a technology-focused ETF out there with better performance than the well-known QQQ.

Commodity ETFs allow investors to gain access to liquid and volatile commodity markets, like oil, gold, copper or coffee, which were previously limited to commodities traders registered with exchanges. Commodity ETFs are often based on derivatives, rather than the physical asset, so can carry a higher risk. The other cost to be aware of are the fees charged by the ETFs themselves for managing the funds.

How do you trade ETFs?

As an ETF that tracks the performance of the Nasdaq-100 index, it has delivered some of the best long-term returns since it came into existence in 1999. For reference, the Nasdaq-100’s components are the 100 largest non-financial companies in the tech-heavy Nasdaq Composite, so it will come as little surprise that more than half of its weight is in tech. ETF trading provides a way for investors to gain exposure to assets that were not easy to trade previously, such as physical commodities or stocks on international exchanges.

Talk to your financial planner to explore how iShares ETFs may fit your investing goals. TD Ameritrade receives remuneration from certain ETFs for shareholder, administrative and/or other services. Diversification does not eliminate the risk of experiencing investment losses. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. It’s important to keep in mind that ETFs are generally designed to be maintenance-free investments. ETFs are also good tools for beginners to capitalize on seasonal trends.

While profiting from these instruments requires sophisticated skills, the payoff is worth the effort, especially when markets are behaving in a very volatile way, be it trending up or down. Once you’ve decided to invest in ETFs, you need to form your investing strategy. There are several different ETF trading strategies you can use, depending on your preferred approach, risk tolerance, timeframe and overall trading or investing goals. If you want to own shares in an ETF at the current market price, rather than speculate on its future value, you can buy ETFs directly on stock exchanges in the same way as company stocks.

Learn how to invest in exchange-traded funds (ETFs) with this beginner’s guide. The value of your investment will fluctuate over time, and you may gain or lose money. These are symbols that you’re really not certain why they’re moving and with what other symbols.

A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Gordon Scott has been an active investor and technical analyst or 20+ years.

When you go to place your market order, this gives instructions to your broker that you want this ETF traded immediately, no matter what price it may be. As ETFs are similar to stocks, in so far as they are traded on exchanges, you have the ability to short them, once you have the correct type of account with your broker. This means that you can potentially profit on a falling price movement of a given ETF, even if you don’t own a position in it. This is of course a risky move and could be damaging if it doesn’t pay off. Exchange traded funds (ETFs) are similar in many ways to mutual funds, but they are actually traded in a more similar way to equities. They are mainly a basket made up of different securities which are traded similarly to how normal stocks are on an exchange.

You may want to seek out indexes and ETFs that focus on dividend aristocrats, companies that have historically raised their dividend payments regularly. If your holdings have shifted more than about 5% from your desired breakdown, you may want to buy and sell certain investments to bring yourself back to your desired level of risk. This isn’t necessarily a complicated or time-consuming process, but if you’d prefer to set it and forget it with your investment portfolio, a robo-advisor can do this for you automatically. You’ll want to choose indexes that reflect the asset allocation you’re aiming for. Stock-based indexes, like the S&P 500, NASDAQ and Dow Jones Industrial Average, are good starting points for the stock component of your portfolio.

A lot of people use ETF trading to work on their asset allocation depending on the mood of the market. For example, if there is high volatility, they will favour lower volatility ETFs that focus on stocks which do not have as much volatility, as well as those holding significant amounts of bonds and cash etc. Index exchange traded funds allow investors to gain exposure to an entire stock market index, such as the S&P 500 (US500), the Nasdaq 100 (US Tech 100) or the FTSE 100 (UK100). Index ETFs aim to track the performance of their benchmark index, either by holding the shares of the constituent stocks in the index or other investment products that follow its price movements. An exchange-traded fund (ETF) is a type of pooled investment security that operates much like a mutual fund. Typically, ETFs will track a particular index, sector, commodity, or other assets, but unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a regular stock can.

Login LimeFX International

LimeFX calls its mission to provide access to global financial markets for all categories of the population and increase its financial literacy. Now the LimeFX broker works with more than 1 million users from 150 countries of the world (except for limefx scammers the CIS, it is especially popular in the USA, Great Britain, UAE, Germany, India). In the first years of her work, she entered the TOP-10 rating of the largest forex brokers in the world, subsequently often occupying leading positions in it.

- Let’s consider forex trading using the example of the MetaTrader 5 terminal for PC.

- Downloading the installation file is initiated through the appropriate sections on the side or bottom horizontal panel.

- Access to a vast range of financial products, flexible leverage, tight spreads and instant execution speed.

- This will open the window of the payment channel corresponding to the selected input method.

- All with the confidence you’re joining a trusted global leader, with over 25 years’ experience – and more than 1 million clients worldwide.

Among traders, it is difficult to find someone who has not heard of the LimeFX broker. This is not surprising at all, considering its presence in the market for over 20 years and universal recognition from both industry experts and numerous clients. Open an account and get instant access to trade ideas, analysis and personal support. Choose from LimeFX Mobile, our easy, yet powerful mobile app, or MetaTrader 4 or 5, the world’s most popular feature-rich platform with advanced charting and analysis. Due to a migration of services, access to your personal client area is temporarily disabled. LimeFX’s experts provide detailed market analysis to help traders keep on top of the latest trading news.

Investments

LimeFX International offers an array of live trading accounts to choose from. Each one offers the investor different opportunities, and allows you to trade in different ways. Browse the specifications of our Standard, Micro, Pro and ECN Accounts to find your best fit.

To make an application for withdrawing money from the LimeFX website, click “Withdraw funds” in the side menu and select one of the available payment channels. There are slightly fewer withdrawal options in some categories. In the window that opens after this, you need to select an asset from the available options in the list on the left, set the execution time (above the chart) and the contract amount (on the right). Then it remains only to press “BUY” or “SELL” to select the estimated direction of movement of the asset rate. Charts can be closed and new ones can be “pulled out” through the context menu called by right-clicking on any asset in the list. At the same time, the number of windows with charts is not limited, and indicators are added to them.

As for analytics, LimeFX offers detailed market overviews with forecasts, a calendar of current economic events and information on currency exchange rates. In addition, fundamental and technical analysis tools are available that help to automatically predict the further movement of the rate of assets available for trading through LimeFX terminals. For novice traders and those who wish to improve their existing Forex trading skills, LimeFX offers a fairly wide range of educational materials — online courses, video tutorials and articles.

LimeFX: Registration, Log In, How to Trade on LimeFX

Take advantage of both rising and falling prices with Stocks CFDs from a leading global broker. To find out what exciting offers are available, go here now.

- If all instructions are followed correctly, the funds will appear on the user’s balance immediately after the transaction is processed by the system.

- This is not surprising at all, considering its presence in the market for over 20 years and universal recognition from both industry experts and numerous clients.

- If after the first launch of the terminal some of them are missing, enable the ones you need through the “View” menu.

- Among traders, it is difficult to find someone who has not heard of the LimeFX broker.

In the case of Bitcoin, this is 6 network confirmations (20-60 minutes). To deposit the user’s account on the LimeFX website in the Personal Account, press the button of the same name. In addition to binary contracts with a choice of the direction of the rate, LimeFX offers options “one touch”, “range”, “spread”, “express” and “turbo”. To create an account, you can use the corresponding functions of the sidebar or the buttons limefx reviews in the drop-down menu in the footer of the LimeFX website. If two-factor authentication was enabled in the security settings, after the login and password there will be another window in which you need to enter the 2FA code sent by the system as an SMS to your phone. In the form that opens after this, you need to enter the email (specified when creating the account) or the account number and the corresponding password.

What is LimeFX

It also displays the size of the commission and the current conversion rate (if the currency of the account and card is different). In December 2018, the Central Bank of the Russian Federation revoked the license of LimeFX Forex LLC, which was the broker’s official representative in Russia. But Russians can still use its services through the international site LimeFX.com.

Please contact us via email or Live Chat and we’ll assist you with any enquiries. Choose to work with a brand that serves more than 2 million traders worldwide. 17Micro Accounts offer a fixed leverage which is based on your experience and knowledge and can be changed within your MyLimeFX. 11 Please note that margin requirements may vary between symbols and servers. For further information please refer to the Leverage and Margin Requirements section. If all instructions are followed correctly, the funds will appear on the user’s balance immediately after the transaction is processed by the system.

Demo Trading Accounts

Let’s consider forex trading using the example of the MetaTrader 5 terminal for PC. Downloading the installation file is initiated through the appropriate sections on the side or bottom horizontal panel. Of course, beginners are advised to first try their hand at trading on an LimeFX demo account and only then move on to transactions with real funds.

According to the regulations, withdrawal requests are processed by the LimeFX system within one business day. When a trade is opened, its type (by market, exchange execution, etc.) and volume (number of lots), as well as stop loss and take profit values (in points from the purchase price) are indicated. The program is installed in one click and is ready for use in 1-2 minutes. After launching it, you need to enter the username / password received after creating a trading account and select a server.

Live Trading Accounts

Also, the function of depositing funds is present in the side menu, in which you can immediately select the appropriate payment channel. Having familiarized yourself with the interface and basic functions of the MT5 terminal, you can start trading using your own strategies or following the advice from LimeFX’s training and analytics sections. All these elements, if desired, move freely to different parts of the terminal window.

Withdrawal

Copy the strategies of more experienced traders and profit when they do. Trade FX with great leverage, no commission options, and spreads from zero. LimeFX Comoros does not provide services to residents of the USA, Japan, Canada, Australia, the Democratic Republic of Korea, European Union, United Kingdom, Iran, Syria, Sudan and Cuba. Manage your account https://limefx.name/ and trades, across all instruments and assets, on your favourite platform. With free deposits and rapid withdrawals, LimeFX’s secure, localised payment solutions suit the needs of traders worldwide. In general, the level of LimeFX’s reputation speaks for itself — if the above problems really existed, this broker would not be so popular among traders.

First of all, these are the Financial Supervisory Authority (FSA) of Saint Vincent and the Grenadines, as well as the International Financial Services Commission (IFSC) of Belize. With fully segregated client funds, backed by top-tier banks and award-winning service. If you didn’t receive this email in your Inbox, check your Junk and Spam folders. If you still can’t find it, please use the password reset service. An alternative LimeFX website offers services that are better suited to your location.

PENN PENN Entertainment Inc Analyst Estimates & Rating

The company is scheduled to release its next quarterly earnings announcement on Thursday, November 2nd 2023. Sign-up to receive the latest news and ratings for PENN Entertainment and its competitors with MarketBeat’s FREE daily newsletter. When you see PENN stock appear in the results, tap it to open up the purchase screen. Provides a general description of the business conducted by this company. Disney isn’t getting out of the sports business, it’s trying to play a central role in the future of sports. While it looks as though the major indexes will end up down on the week, their first in the last three, there remain some unusually active options that allow you to buy these stocks for only $150 down….

Alternative Assets.Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of 1933 (as amended) (“Regulation A”). These investments are speculative, involve substantial risks (including illiquidity and loss of principal), and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser. The issuers of these securities may be an affiliate of Public, and Public (or an affiliate) may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures.

Per-Share Earnings, Actuals & Estimates PENN Entertainment Inc.

30 employees have rated PENN Entertainment Chief Executive Officer Jay Snowden on Glassdoor.com. Jay Snowden has an approval rating of 87% among the company’s employees. Get this delivered to your inbox, and more info about our products and services.

The Barchart Technical Opinion rating is a 100% Sell with a Strongest short term outlook on maintaining the current direction. Gaming, specifically gambling, is growing in all segments and these companies are working hard to cement their positions and drive results for shareholders. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Related Articles PENN

Shares in sports gambling names have fallen in the wake of Penn’s $2 billion deal for ESPN rights. Belpointe Chief Strategist David Nelson joins Yahoo Finance Live anchors Seana Smith and Akiko Fujita to discuss the stock market, interest rates, and why his buys are Disney (DIS) and energy sector s… Truist Securities analyst Barry Jonas downgraded his rating of Penn to Hold from Buy. Joe Pompliano, Sport Business Analyst, joins ‘Last Call’ to talk the PENN-ESPN deal, why Penn’s stock is lower and what the future of the partnership could look like.

Compare

PENN’s historical performance

against its industry peers and the overall market. Morningstar analysts hand-select direct competitors or comparable companies to

provide context on the strength and durability of PENN’s

competitive advantage. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

Financials

In February 2020, casino operator and online betting company Penn Entertainment Inc. took a 36% stake in Barstool Sports for $161 million. With the ESPN and Penn Entertainment deal, Disney is officially entering the world of sports betting. PENN’s beta can be found in Trading Information at the top of this page.

ESPN Bet Sports Gambling Platform Will Be Massive: 5 Top ‘Strong Buy’ Stocks May Be Huge Winners – 24/7 Wall St.

ESPN Bet Sports Gambling Platform Will Be Massive: 5 Top ‘Strong Buy’ Stocks May Be Huge Winners.

Posted: Tue, 12 Sep 2023 11:10:07 GMT [source]

The retail portfolio generates high-30% EBITDAR margins and helps position the company to obtain licenses for the digital wagering markets. Additionally, Penn’s media assets, theScore and ESPN (starting with its partnership launch in Fall of 2023), provide access to sports betting/iGaming technology and clientele, helping it form a leading digital position. 17 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for PENN Entertainment in the last twelve months. The consensus among Wall Street analysts is that investors should “hold” PENN shares. A hold rating indicates that analysts believe investors should maintain any existing positions they have in PENN, but not buy additional shares or sell existing shares.

Is PENN Entertainment (PENN) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. 17 analysts have issued 12-month price objectives for PENN Entertainment’s stock.

Penn Entertainment (PENN) stock is up on the news of the company’s sports betting deal with ESPN (DIS). Yahoo Finance’s Josh Schafer joins the Live show to discuss the sports betting market, whether t… High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

PENN Entertainment Inc. stock falls Thursday, underperforms market

Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Open to the Public Investing’s Fee Schedule to learn more. JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. Additional information about your broker can be found by clicking here.

- The analysts see these stocks trading at extreme lows with nowhere to go but up, and there are catalysts to drive their markets higher.

- Shares in sports gambling names have fallen in the wake of Penn’s $2 billion deal for ESPN rights.

- PENN Entertainment’s stock is owned by a number of institutional and retail investors.

When Penn Entertainment Inc. announced plans on Tuesday to launch an ESPN-branded online sports-betting service, shares of the casino operator initially rallied. PENN Entertainment declared that its board has initiated a stock repurchase program on Thursday, February 3rd 2022, which permits the company to repurchase $750,000,000.00 in outstanding shares, according to EventVestor. This https://1investing.in/ repurchase authorization permits the company to buy up to 9.8% of its shares through open market purchases. Shares repurchase programs are generally an indication that the company’s board of directors believes its stock is undervalued. You can find your newly purchased PENN stock in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets.

PENN Entertainment shares drop below pre-ESPN deal levels

CNBC’s Julia Boorstin joins ‘The Exchange’ to discuss Disney’s upcoming earnings report, a decline in Disney’s Florida theme park performance, and ESPN’s $2 billion investment into Penn entertainment … ESPN just struck a $1.5 billion deal with Penn Entertainment to rebrand Barstool Sportsbook as ESPN Bet. ESPN will buy $500 million in shares of Penn, and sell its stake in Sportsbook back to founder …

Tower Research Capital LLC TRC Buys 20787 Shares of PENN … – MarketBeat

Tower Research Capital LLC TRC Buys 20787 Shares of PENN ….

Posted: Fri, 18 Aug 2023 07:00:00 GMT [source]

No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.

Disney’s ESPN has signed a long-term exclusive agreement with casino operator Penn Entertainment, licensing its brand for sports betting and deepening the media giant’s ties to the growing online gamb… Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The bailor meaning in law formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

What is the difference between Pound and Sterling?

Three British Overseas Territories (Gibraltar, Saint Helena, and the Falkland Islands) also have currencies called pounds which are at par with the pound sterling. It’s a good idea to shop around, as exchange rates and commission fees can vary widely from one place to the next. The easiest way to find out which option is best is to ask how many pounds you will receive for your money after all of the charges have been deducted. If you’re headed to a rural area, it’s also a good idea to exchange money at your first point of entry.

It is a sterling pound but the word “sterling” is omitted on banknotes, as on the English ones. The bank issued its first banknotes in 1694, although before 1745 they were written for irregular amounts, rather than predefined multiples of a pound. It tended to be times of war, which put inflationary pressure on the British economy, that led to greater note issue. In 1759, during the Seven Years’ War, when the lowest-value note issued by the Bank was £20, a £10 note was issued for the first time. In 1793, during the war with revolutionary France, the Bank issued the first £5 note.

Inflation caused the farthing to cease production in 1956 and be demonetised in 1960. In the run-up to decimalisation, the halfpenny and half-crown were demonetised in 1969. In 1816, a new silver coinage was introduced in denominations of 6d, 1/–, 2/6d (half-crown) and trade bonds online 5/– (crown). It was followed by a new gold coinage in 1817 consisting of 10/– and £1 coins, known as the half sovereign and sovereign. The silver 4d coin was reintroduced in 1836, followed by the 3d in 1838, with the 4d coin issued only for colonial use after 1855.

Here is a collection of coins, with £2 in pound coins and some more pence coins. In this example, we have two pound coins and some pence coins. We can add combinations of coins by grouping them into totals that equal 100 pence. Any combination of coins that add up to 100 pence are worth £1. In total we have £2 and 80 pence, which is written as £2.80.

The governments of these territories print their own banknotes which in general may only be used within their territory of origin. Bank of England notes usually circulate alongside the local note issues and are accepted as legal currency. The Isle of Man Government issues its own banknotes and coinage, which are legal tender in the Isle of Man.

For example, here is a group of British coins, which we will add to find a total. Sterling refers to the standard measurement of precious metals. Hunt has already warned that tax cuts in the November Budget are “virtually impossible”. Already facing a very difficult election campaign next year, the pound’s decline will only add to Sunak and Hunt’s woes. However, the pound’s weakness is also being driven by the strength of the dollar. The euro, which is unperturbed by the actions of the Bank of England, has also fallen to a six-month low against the greenback, indicating the worldwide strength of America’s currency.

How Much Money Is a Pound of $20 Bills?

Usually, sterling is used in the wholesale financial markets, although not when it comes to describing actual amounts. For example, converting the sentence “Payment for this is accepted in sterling” to “Payment for this is five sterling” is wrong. The the tradeallcrypto crypto broker British pound is a type of currency, much like the euro for Spain and the dollar for the USA. Some say that the basis of this currency dates back to the Anglo-Saxon period. Sizeable transactions were made through the exchange of pounds of sterlings.

4.The pound is the fourth most-traded currency in the world’s foreign exchange market, the first being the U.S. dollar, followed by the euro, and then the Japanese yen. You have several different options when it comes to exchanging currency in the U.K. Private bureaux de change belonging to companies like Travelex can be found on the high streets of most towns and cities, and in major train stations, ferry terminals, and airports. Popular department store Marks & Spencer also has a bureau de change desk in many of its nationwide outlets. Alternatively, you can exchange money at most bank branches and post offices.

- Sometimes we cannot make exactly one pound because we cannot make a group of exactly 100 pence.

- Until the middle of the 19th century, privately owned banks in Great Britain and Ireland were free to issue their own banknotes.

- Five times 20p equals 100p and so, five 20p coins are worth £1.

- Most of the notes issued by the note-issuing banks in Scotland and Northern Ireland have to be backed by Bank of England notes held by the issuing bank.

A gold standard was created, which allowed conversion between different countries’ currencies and revolutionized trading and the international economy. Great Britain officially adopted the gold standard in 1816, though it had been using the system since 1670. The strength of the Sterling that came with the gold standard led to a period of major economic growth in Britain until 1914. By the 19th century, lot size calculator sterling notes were widely accepted outside Britain. The American journalist Nellie Bly carried Bank of England notes on her 1889–1890 trip around the world in 72 days.[68] During the late 19th and early 20th centuries, many other countries adopted the gold standard. As a consequence, conversion rates between different currencies could be determined simply from the respective gold standards.

Quick Conversions from United States Dollar to British Pound Sterling : 1 USD = 0.8277379 GBP

From 1844, new banks were excluded from issuing notes in England and Wales but not in Scotland and Ireland. Consequently, the number of private banknotes dwindled in England and Wales but proliferated in Scotland and Ireland. The last English private banknotes were issued in 1921. The first sterling notes were issued by the Bank of England shortly after its foundation in 1694. Denominations were initially handwritten on the notes at the time of issue.

How Can Investors Trade the GBP?

As the fourth most traded currency, the British Pound is the third most held reserve currency in the world. Common names for the British Pound include the Pound Sterling, Sterling, Quid, Cable, and Nicker. Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. The pound has only been divided into 100 pence since 1971. Sterling is freely bought and sold on the foreign exchange markets around the world, and its value relative to other currencies therefore fluctuates.

Recent business surveys show the economy is slowing down, reducing the gap with the continent. By contrast, the Bank of England only expects the UK economy to grow by just 0.5pc this year, the same slow rate in 2024 and a meagre 0.25pc in 2025. Projections also show the world’s largest economy is set to grow by around 2pc this year, 1.5pc next year and 1.8pc in 2025.

In medieval Latin documents the words libra, solidus, and denarius were used to denote the pound, shilling, and penny, which gave rise to the use of the symbols £, s., and d. The pound sterling banknotes in current circulation consist of Series G Bank of England notes in denominations of £5, £10, £20 and £50. The obverse of these banknotes all feature the portrait of Elizabeth II originally introduced in 1990. Over time, banknotes featuring Elizabeth II will be phased out and replaced with notes featuring a portrait of Charles III.[i] Select banks in Scotland and Northern Ireland also issue their own banknotes at par with Bank of England issues. Scottish and Northern Irish notes may be rejected as payment in England by merchants unfamiliar with them, and are likely difficult or impossible to exchange outside Britain. Three British overseas territories use their own separate currencies denominated in pounds which are at par with the pound sterling.

Xe Currency Charts

There is also a currency known as the pound sterling, which creates confusion due to the combination of two separate currencies. Here, we will discuss the differences between the pound and the sterling. 6.The United Kingdom currency is better known by the word “pound”, while “sterling” is used in the financial market.

Contactless card payments are becoming increasingly popular in the U.K. You can use contactless Visa, Mastercard and American Express cards to pay for public transport in London, and for POS payments under 30 pounds in many shops and restaurants. Alternatively, it’s also possible to use your regular bank card to withdraw local currency from an ATM (often called a cashpoint in the U.K.). Any international card with a chip and PIN should be accepted at most ATMs—although Visa, Mastercard, Maestro, Cirrus, or Plus cards are your safest bet. Accounts, although these are usually minimal and often cheaper than the commission charged by bureaux de change. The British pound competes with the U.S. dollar (USD), euro (EUR), and Japanese yen (JPY) in daily volume trading.

The GBP is the oldest currency in the world that is still used as legal tender. Symbolized by the pound sign (£), the GBP has one of the highest trading volumes in the world. The British pound became the official currency of the United Kingdom when England and Scotland united to form a single country in 1707, but the pound was used as a form of money in the year 760. Until 1855, when printing began, the Bank of England wrote all banknotes by hand. In 1971, the pound sterling of the United Kingdom and the Irish Pound of Ireland were decimalised (divided into 100). The crown and sovereign were legal currency before 1971.